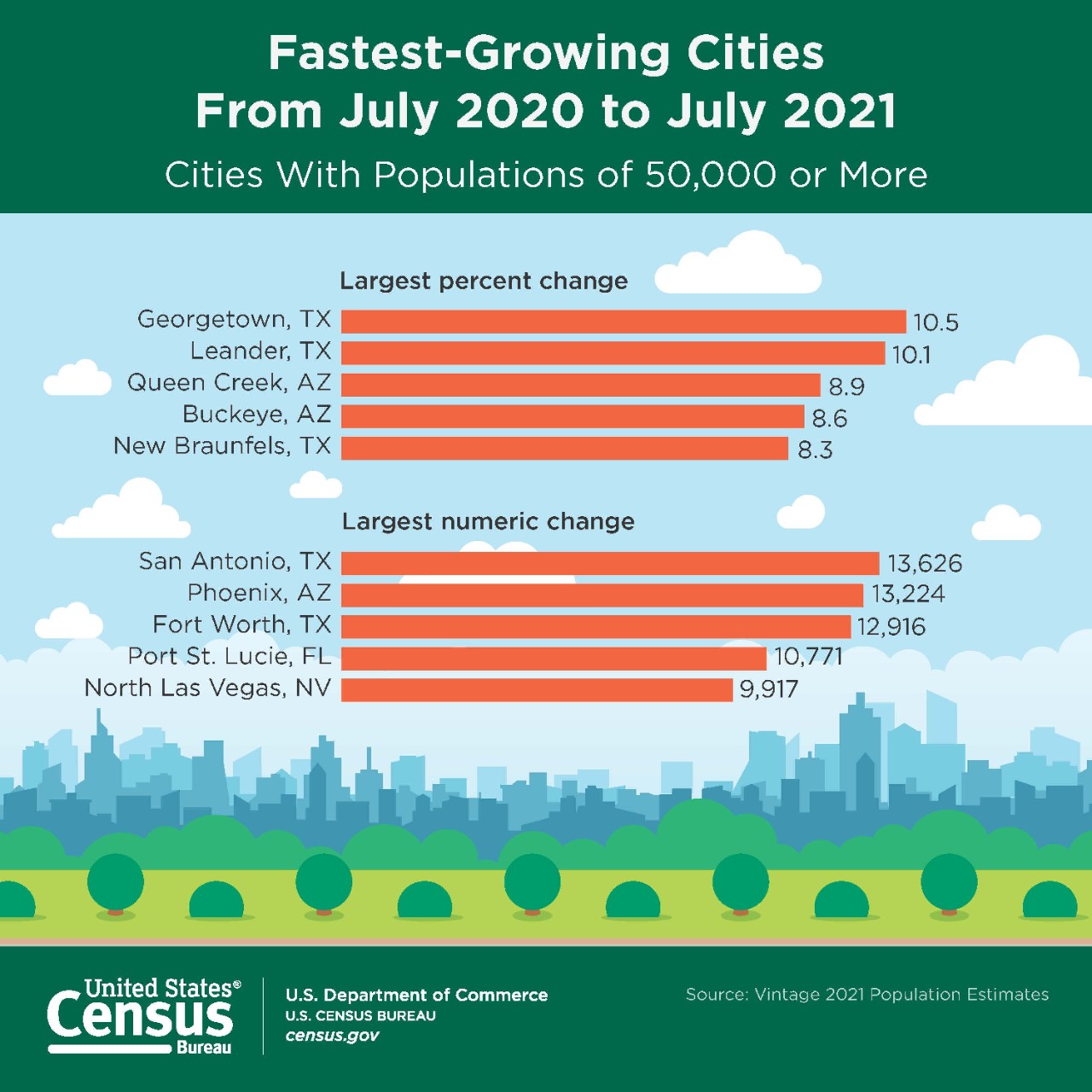

Dallas Lost Nearly 15,000 People Between 2020 and 2021

Between 2020 and 2021, nearly 15,000 people moved out of Dallas.

Specifically, the city lost 14,777 people during that time period, according to a new report from the U.S. Census Bureau.

Countywide, Dallas County lost about 25,000 people during that same time frame.

[Source: U.S. Census Bureau]

Dallas grew by 8.9% between 2010 and 2020 or about 100,000 residents, but neighboring Collin County grew by 36.1%, Rockwall County grew by 37.6%, Tarrant County grew by 16.7%, Kaufman County grew by 40.6%, and Denton County grew by 36.8%. Now, Dallas is losing people.

Rockwall County also led the nation in housing stock growth at 6.5% between July 1, 2020, and July 1, 2021.

Difficulties in purchasing a home could explain these trends. Both home prices and mortgage interest rates are up, and buyers are increasingly priced out of the Dallas housing market.

The median family income rose by about 5.5% between 2020 and 2021, but the median home price rose by 5.5% in the first quarter of 2020 and by 17.2% in the first quarter of 2021, so the rise in home prices outpaced income growth, according to a report from the Texas Real Estate Research Center at Texas A&M University.

“As mortgage interest rates increase, the total monthly mortgage payment also increases,” said Dr. Clare Losey, assistant research economist for TRERC. “This increases the required income to qualify for a mortgage loan. In other words, as mortgage interest rates increase, purchasing power declines, and households must earn more money to purchase the same-priced home.”

At the start of 2022, the 30-year fixed-rate mortgage average in the U.S. hovered around 3 percent, according to Freddie Mac. By May 19, the average rate had jumped more than 2 percentage points to 5.25 percent.

“In the first quarter, the required income to qualify for a mortgage loan at a rate of 3 percent amounted to $59,665 for the first-quartile Texas sales price of $229,000. The first-quartile sales price generally reflects the home price affordable to first-time buyers,” said Losey.

The required qualifying income increased more than $10,000 to $70,891 at a rate of 5.5 percent. She estimates only 30 percent of Texas renters—potential first-time buyers—could afford the state’s first-quartile sales price at 5.5 percent.

In Dallas County, the median home price rose 17.5% compared to April 2021, according to the MetroTex Association of Realtors. Nearby counties reported similar or higher increases, but the median price tends buy more in exurbs and suburbs like Little Elm, Garland, or Grand Prairie, per a search of listings at realtor.com.

Read more from our sister publication D Magazine here.